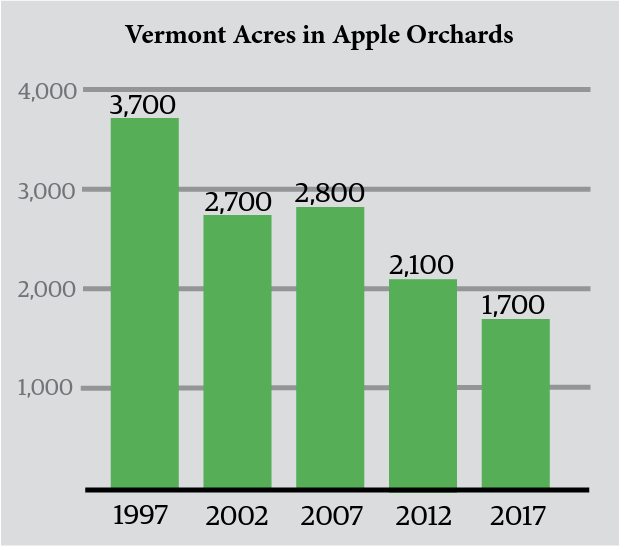

Apples in Vermont are behind only dairy and maple in total annual crop value. Since the 1990s, Vermont’s share of all apples sold to eastern U.S. wholesale markets has decreased. Apple acreage fell from approximately 3,500 acres in 2001 to 1,700 acres in 2017. Local sales at pick-your-own and farm stand sales have increased, and cider markets have grown, but have not replaced lost volume nor revenue from wholesale sales. Some Vermont orcharding communities are seeing a loss of economic activity from crop sales and farm employment and the disenfranchisement of growers. Without supportive policies and more investment in marketing, technical assistance, and supply chain coordination, Vermont growers will continue to lose out to growers in regions where larger concentrations of orchards have the advantage in efficiency, modernization, and infrastructure.

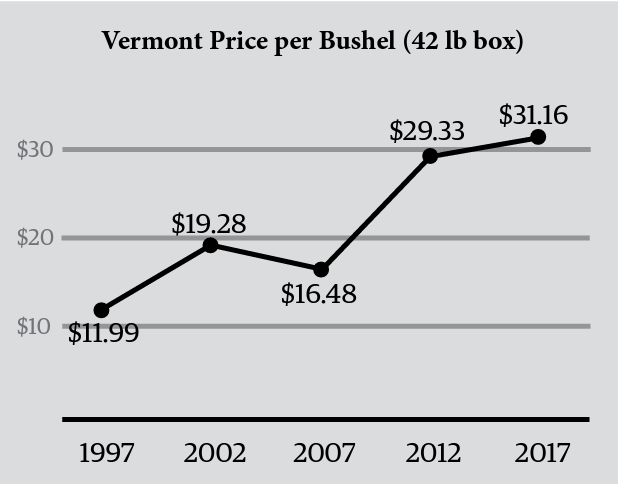

Wholesale apple producers are presently experiencing very difficult economic circumstances. Apples have historically been one of Vermont’s primary regional wholesale crops, and thus provide significant revenue from out of state. Vermont orchards are planted primarily to McIntosh and similar varieties, but consumer tastes are shifting to newer varieties that require replanting of orchards. Recent shifts in marketing to in-state buyers has increased per-bushel prices paid to growers who are selling fewer fruit into commodity markets, but the increased value has not offset reduced sales volume that previously supported about twice the orchard acreage that Vermont now has. This shift has led to contraction in the wholesale market, facilitated by loss of in-state packing and distribution facilities. Some growers have adopted direct store delivery models by assuming their own packing and distribution systems, but limited outlets and local population limits potential growth.

Licensed hard cider manufacturers have increased to 24 in 2019 from less than ten in 2010, but the prices paid for cider apples are typically one half to one sixth the price for packed fresh fruit. Higher-value cider apples require growing unique varieties with no secondary market and sometimes unknown production needs. Orchards take three to ten years to reach full production, and installation costs up to $30,000 per acre. This causes barriers to entry as time between investment and return requires saved or borrowed capital. Apples also have substantial, unique, and annual pest management needs relative to most annual crops. Despite recent losses in technical support at UVM Extension, private-sector technical assistance has been provided by a consultant with the primary agrichemical product dealer who works closely with UVM personnel to expand technical assistance services to growers.